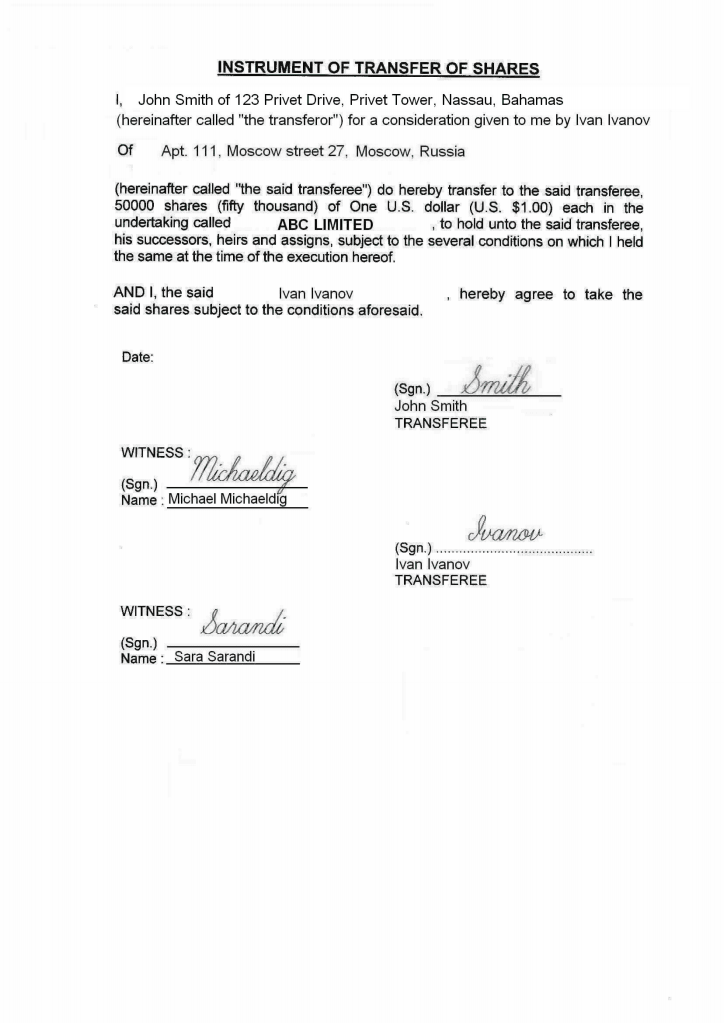

1123 and 113 below in this Chapter relevant business property means in relation to any transfer of value a property consisting of a business or interest in a business. A stock transfer form transfers shares from one person to another.

It indicates number of shares and price of the shares being transferred along with other details of the transferor and.

. 3 Section 105 1 of CA 2016 subject to any other written laws any shareholder or debenture holder may transfer all or any of his shares or debentures in the company by a duly executed and stamped instrument of transfer and shall lodge the transfer with the company. 1 Instrument of transfer must be executed by both transferor and transferee. 105 Relevant business property.

Section 105 FORM OF TRANSFER OF SECURITIES. The following are the steps in transfer of shares. 2 It must be duly stamped.

We Make Legal Simple. It is used when a shareholder intends to sell or transfer their company shares to another party. This Instrument of Transfer of Securities Section 105 document for shares transfer in the company between the transferor and transferee.

Course Title LAW 2053. Section 105 Instrument of Transfer of Securities Similar to previous Form 32A. It outlines the particulars of the party selling or transferring the transferor their shares to another the transferee the amount of.

TRANSFER OF SHARES under section 105 1 Section 105 is applicable to transfer of. 1 Subject to the following provisions of this section and to sections 106 108 F1. Stamps of appropriate value must be affixed.

Contribute to kauntocompanies-act-2016 development by creating an account on GitHub. Section 1051 of the Companies Act 2016 required any shareholder or debenture holder may transfer all or any of his shares or debentures in the company by a duly executed and stamped instrument of transfer and shall lodge the transfer with the company. 1 The certification by a company of an instrument of transfer of any shares in or debentures of the company is to be taken as a representation by the company to any person acting on the faith.

Transfer of shares under section 105 1 section 105 is. 41 or ii is in accordance with regulations under chapter 2 of this part. Securities of a company which F3 are unquoted.

Execution and Delivery of Instrument of Transfer Section 56 1 and Rule 11 1 of the Companies Share Capital and Debentures Rules 2014 Both transferor and transferee or anyone on their behalf shall execute instrument of transfer of securities in Form SH-4. 3 Section 1051 of CA 2016 subject to any other written laws any shareholder or debenture holder may transfer all or any of his shares or debentures in the company by a duly executed and stamped instrument of transfer and shall lodge the transfer with the company 4 Section 1053 of CA 2016 For the purpose of effecting the transfer of shares or debentures the company. The section states that subject to other written laws any shareholder may transfer all or any of his shares in the company by a duly executed and stamped instrument of transfer and shall lodge the transfer with the company.

FRS 105 section 9 provides a business with specific guidance on accounting for all financial instruments. Lease definedA lease of immoveable property is a transfer of a right to enjoy such property made for a certain time express or implied or in perpetuity in consideration of a price paid or promised or of money a share of crops service or any other thing of value to be rendered periodically or on specified occasions to the. Easy-To-Create Documents For Every Stage Of Life And Business.

Boards Resolution Approval from the Board of Directors to accept the transfer of shares. There are certain exceptions to. If you use a stock transfer to buy stocks and shares for 1000 or less you do not normally have to pay any Stamp Duty.

Following Procedure is to be followed. In order to transfer shares in a sdn bhd company from one person to another person in Malaysia the following documents are needed to complete the shares transfer. The transfer of a registered share under the companies act is by a written instrument of transfer signed by the transferor and containing the name and address of.

Find Out How to Transfer Shares Today. The instrument of transfer of a share may be in any usual form or in any other form which the directors may approve and shall be executed by or on behalf of the transferor and unless the share is fully paid by or on behalf of the transferee. The instrument is to be checked thoroughly to find out whether the same is in order.

3 It must be delivered to the company along with certificate relating to shares transferred. Section 105 Instrument of Transfer of Shares previously named Form 32A This document contains all the information on the number of shares price of shares and other details and it is an agreement between the transferor and transferee when a transfer of shares is done. 12 Procedure for transfer of Shares.

On receipt of the transfer instrument duly executed in the prescribed form together with the share certificate or allotment letter it is usual for companies to give an acknowledgment for the same. School Tunku Abdul Rahman University College Kuala Lumpur. Transfer of Shares.

A shareholder or debenture holder may transfer all or any of his shares or debentures in the company subject to any written law by a duly executed and stamped instrument of transfer and shall lodge the transfer with the company Section 1051 CA 2016. Ad Easily Transfer Shares From One Person To Another. 4 Must be in the prescribed form and presented to prescribed authority.

The expression transfer of a right to enjoy stands in contrast with the words transfer of ownership occurring in Section 54 in the definition of sale. The Share Transfer Form also called the Share Transfer Instrument is a standard document required for the transfer of shares in a company. A transfer of shares is prescribed under section 1051 of CA 2016.

As per Section 105 Transfer Of Property Act a lease of immovable property is a transfer of a right to enjoy such property made for a certain time or in perpetuity. Finally the SECTION 105 FORM will be. 1 Notwithstanding anything in its articles a company shall not register a transfer of shares or debentures unless a proper instrument of transfer in the prescribed form has been delivered to the company but this subsection shall not prejudice any power to register as a shareholder or debenture holder any person to whom the right to any shares in or debentures.

A company can purchase its own shares under section 105 companies. A note on the applicable law and procedure when transferring shares issued in certificated form by a company incorporated in England and Wales.

The Concept Of Transfer Of Beneficial Ownership Of Securities Azmi Associates

Company Secretary Cosec Services Sdn Bhd Ipoh Mon T Kiara Kl C Highlands Penang

Section 105 Instrument Of Transfer Of Shares Nashcxt

Shares Capital Maintenance Law Legal Articles By Hhq Law Firm In Kl Malaysia

Company Registration In The Bahama Islands Business Starting Setup Offshore Zones Gsl

Malaysia Transmission Of Shares Universal Succession Conventus Law

Transferring The Shares Of A Sdn Bhd Company In Malaysia